Ethereum Price Prediction 2025-2040: Technical Breakout and AI Integration Fuel Long-Term Bull Case

#ETH

- Technical Breakout Potential - ETH trading above 20-day MA with converging MACD suggests building bullish momentum toward upper Bollinger Band resistance

- Institutional Accumulation - $300M whale buying and new financial products like on-chain corporate notes demonstrate growing institutional confidence

- AI-Driven Ecosystem Growth - AI integration in NFT markets and trading tools creating new utility and demand drivers for Ethereum network

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

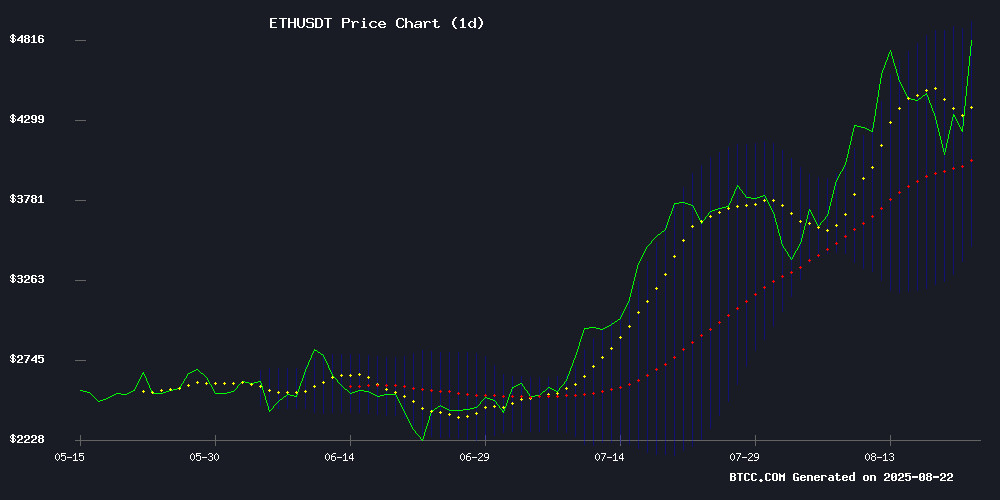

Ethereum is currently trading at $4,307.52, positioned above its 20-day moving average of $4,182.26, indicating underlying bullish momentum. The MACD reading of -16.24, while negative, shows improving momentum as the histogram narrows. Price action remains within the Bollinger Bands range of $3,508.21 to $4,856.32, with the current level suggesting room for upward movement toward the upper band resistance.

According to BTCC financial analyst Olivia, 'ETH's ability to hold above the 20-day MA while MACD shows signs of convergence suggests consolidation may be giving way to renewed bullish momentum. The $4,856 upper Bollinger Band represents immediate resistance, while support sits NEAR $3,508.'

Market Sentiment: Mixed Signals Amid Institutional Accumulation and Regulatory Uncertainty

Current market sentiment for ethereum presents a complex picture. Positive developments include significant whale accumulation totaling $300 million and innovative financial products like Hong Kong's first on-chain corporate note through HashKey Chain and GF Securities. The NFT market revival fueled by AI integration further supports ETH's utility case.

However, regulatory concerns persist with ongoing speculation around the Tornado Cash case stance. BTCC financial analyst Olivia notes, 'While institutional adoption and AI-driven trading tools are creating solid fundamental support, traders should monitor regulatory developments and profit-taking risks given that over 90% of ETH supply is currently in profit ahead of key macroeconomic events.'

Factors Influencing ETH's Price

Ethereum Price Battles Key Resistance Amid Recovery Attempt

Ethereum's price action shows tentative signs of recovery after dipping below $4,200, with bulls now testing critical resistance levels. The second-largest cryptocurrency by market cap recently rebounded from a swing low of $4,065, currently trading between the 23.6% and 61.8% Fibonacci retracement levels of its recent decline.

A bearish trend line forming NEAR $4,300 on the hourly chart continues to cap upside potential, while the 100-hour moving average adds further technical resistance. Market participants are watching whether ETH can hold above the $4,180 support zone, as failure here could trigger another leg downward.

The $4,350 level remains a key hurdle for any sustained recovery, representing both a psychological round number and the 61.8% Fib level of the recent correction from April highs. Trading volume patterns and order book data from Kraken suggest accumulation is occurring at current levels, though directional conviction remains weak.

HashKey Chain and GF Securities Launch Hong Kong’s First On-Chain Corporate Note

HashKey Chain, an ethereum L2 solution, has partnered with GF Securities to issue Hong Kong's inaugural tokenized corporate note. The unsecured senior USD fixed-rate instrument, guaranteed by Shandong Hi-Speed Holdings, marks a significant leap in institutional adoption of blockchain technology.

The collaboration leverages HashKey Chain's infrastructure to enhance transparency and efficiency in bond markets. This development signals growing convergence between traditional finance and decentralized systems, with GF Securities playing multiple critical roles in the structured product.

Market observers view this as a watershed moment for real-world asset tokenization in Asia's financial hub. The initiative demonstrates how layer-2 solutions can bridge institutional requirements with blockchain's inherent advantages.

DOJ Spokesman's Remarks Spark Speculation on Tornado Cash Case Stance

The U.S. Department of Justice may be softening its approach to cryptocurrency privacy cases, as suggested by recent comments from Acting Assistant Attorney General Matt Galeotti. His speech at Jackson Hole—coinciding with Fed Chair Jerome Powell's anticipated appearance—hinted at a more nuanced stance toward decentralized finance protocols.

Galeotti stated prosecutors won't pursue charges under statute 1960(b)(1)(C) against third parties for truly decentralized software that merely facilitates peer-to-peer transactions without custody control. This comes weeks after Tornado Cash founder Roman Storm's mixed verdict, where he was convicted on this specific charge while being acquitted on another.

The case has become a lightning rod in crypto circles, with privacy advocates and some federal regulators backing Storm's position. Galeotti's remarks, while not directly addressing Storm's case, suggest institutional recognition of DeFi's unique legal challenges—a development that could influence future enforcement actions.

Whale Accumulates $300M Ethereum as Market Stabilizes

Ethereum shows signs of recovery, holding steady above $4,200 after a volatile retreat from near $4,800. Market sentiment is cautiously optimistic as selling pressure eases and technical indicators improve. Analysts suggest that maintaining current support levels could pave the way for a retest of $4,800 and potential new highs.

A significant bullish signal emerged as Arkham Intelligence reported a whale address accumulating $282 million worth of ETH on-chain. This large Leveraged bet reflects strong institutional confidence in Ethereum's medium-term prospects, often a precursor to renewed market momentum.

Ethereum Price Forecast: ETH Risks Selloff as Supply in Profit Tops 90% Ahead of Powell's Speech

Ethereum's price hovers at $4,210 as its supply in profit crosses 90%, a threshold historically associated with heavy selling pressure. Hawkish comments from Cleveland Fed President Hammack and anticipation of Jerome Powell's Jackson Hole speech amplify market caution.

The altcoin's 93% supply-in-profit metric mirrors past corrections—a 50% drop in May 2021 and a 70% crash after its November 2021 peak. Similar patterns emerged in 2024, triggering a 60% decline over three months. Traders now watch the $4,000 support level and a rising trendline for potential stabilization.

Legendary Ethereum Trader Loses $42M in Market Retracement

A once-celebrated Ethereum trader saw nearly his entire $43 million fortune evaporate during the latest market downturn. The individual, who famously turned $125,000 into eight figures during the bull run, was liquidated after Ethereum's sharp price decline.

Blockchain analytics reveal the trader reopened a long position just before the crash, resulting in $6.22 million in liquidations. His account balance now stands at just $771,000—a staggering 98% loss from peak equity. Days earlier, the trader had exited a $303 million ETH position with $6.86 million profit.

The episode underscores the brutal volatility of leveraged crypto trading. What took months to build through 55x gains on initial capital disappeared in forty-eight hours. Ethereum's price action continues to test even the most experienced market participants.

AI Tools Like ChatGPT and Grok Reshape Crypto Trading Strategies

Crypto traders are increasingly relying on AI models such as ChatGPT and Grok to decode market dynamics. These tools provide real-time sentiment analysis, narrative framing, and simplified explanations of complex chart patterns—bridging the gap for novice traders overwhelmed by traditional technical analysis.

Michael Saylor, a prominent industry figure, has endorsed AI-driven research, citing its utility in generating actionable investment theses. The technology’s ability to distill historical trends—like ETH’s price behavior relative to its 200-day moving average—into concise insights has made it indispensable for both retail and institutional participants.

ChatGPT excels in delivering narrative-driven interpretations of market trends, while Grok’s integration with X (formerly Twitter) allows it to capture shifting community sentiments with unmatched speed. This duality is redefining how traders validate hypotheses: first asking 'why' through AI, then confirming 'what' via charts.

NFT Market Revival Fueled by AI Integration and Ethereum's Dominance

The NFT market is showing signs of resurgence after a prolonged downturn, with trading volumes experiencing an 83% month-over-month surge in July. Ethereum remains the backbone of this recovery, as NFT prices climb in tandem with ETH's value.

AI-driven interactivity is reshaping the NFT landscape, transforming static digital assets into dynamic companions. "NFTs can now respond to users, learn from interactions, and evolve over time," says Hamza Eddiouane of FURO, highlighting a shift from speculative JPEGs to utility-focused assets with emotional resonance.

DappRadar data reveals a market bifurcation: while overall 2024 volumes dipped to $13.7 billion from 2023's $16.8 billion, the metaverse segment and AI-enhanced collections are outperforming. This suggests investors are favoring NFTs with tangible use cases over purely collectible assets.

ESCAPE Presale Gains Momentum on Ethereum with $280K Raised, Backed by Hacken Audit and SolidProof KYC

ESCAPE's Ethereum presale has surged to Stage 3, priced at $0.01752, after raising $180,000 within 24 hours. The Web3 infrastructure token aims to simplify crypto interactions with an all-in-one platform for token creation, analytics, and community visibility—eliminating the need for complex coding or cross-chain bridges.

The project's roadmap reflects lessons from its initial LAYER 2 deployment, which achieved an $11.5 million market cap within 48 hours before transitioning to Ethereum Layer 1 for sustainability. ESCAPE's value proposition centers on consolidating fragmented crypto tools into a unified interface, addressing market demand observed during its pilot phase.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and emerging trends in AI integration and institutional adoption, here are our long-term Ethereum price forecasts:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200-$6,800 | $7,500-$9,000 | $10,000+ | ETF approvals, AI integration |

| 2030 | $12,000-$18,000 | $20,000-$35,000 | $40,000+ | Mass DeFi adoption, institutional use |

| 2035 | $25,000-$45,000 | $50,000-$80,000 | $100,000+ | Global settlement layer adoption |

| 2040 | $40,000-$75,000 | $85,000-$150,000 | $200,000+ | Full Web3 ecosystem maturity |

BTCC financial analyst Olivia emphasizes that 'these projections assume continued Ethereum network development, successful scaling solutions, and broader cryptocurrency adoption. Regulatory clarity and macroeconomic conditions will significantly influence these trajectories.'